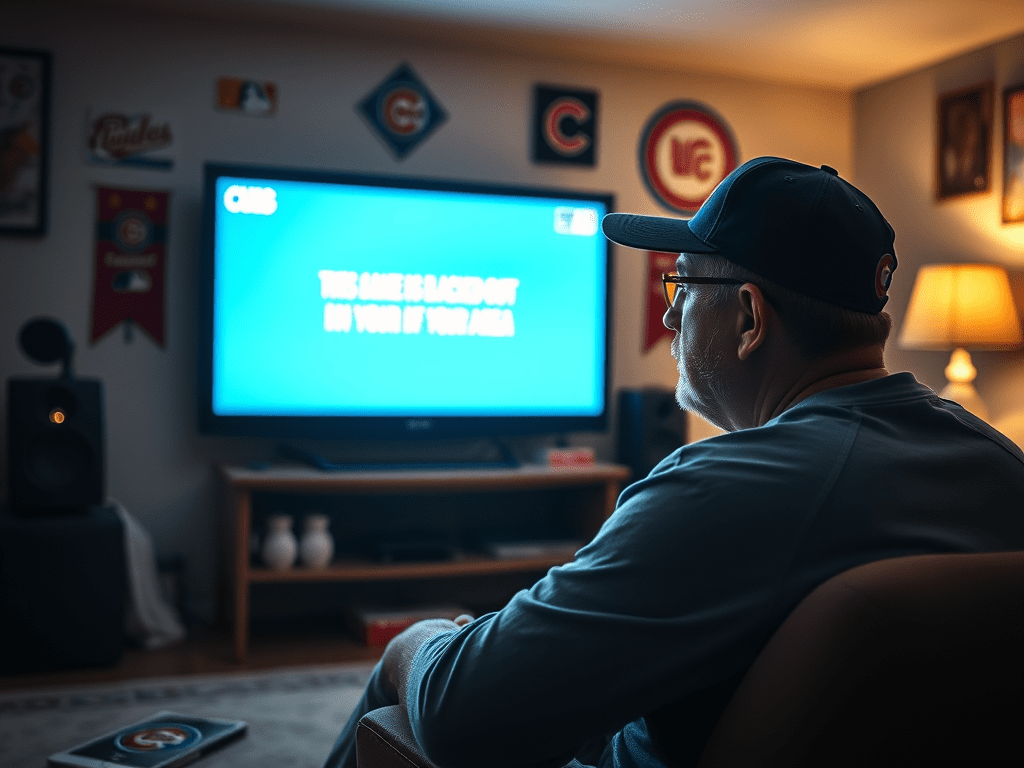

On a summer night in Iowa, a lifelong baseball fan sits down, ready to watch his favorite team, the Chicago Cubs, battle their division rivals. He eagerly opens MLB.TV—only to be met with the dreaded “This game is blacked out in your area” message. Despite living hundreds of miles from Wrigley Field, he’s blocked from watching not just the Cubs, but also five other teams across the Midwest. Frustrated, he turns off the TV. This isn’t just an isolated annoyance—it’s a symptom of a larger crisis in MLB’s media strategy.

As sports broadcasting undergoes a seismic shift, Major League Baseball finds itself at a crossroads. With ESPN set to end its MLB broadcasts after the 2026 season, and the NBA securing a massive new TV contract, the league must confront a rapidly evolving media landscape. Despite MLB’s strong regional ratings—often outperforming NBA teams in shared markets—outdated blackout policies and an uncertain future for television rights could stifle growth in an era where streaming dominates the industry.

Add to that the looming specter of a potential MLB strike, and the league faces a perfect storm of challenges that could reshape how baseball is consumed. To survive and thrive in this new digital era, MLB must reimagine its media strategy, embracing innovative broadcasting models, modernizing its approach to streaming, and adapting to the demands of a changing sports audience.

This article explores the complexities of MLB television rights, the challenges of traditional media deals, and the opportunities that lie ahead in a sports world increasingly driven by digital consumption and fan engagement.

Current State of MLB Television Rights

The landscape of MLB television rights is experiencing significant upheaval, reshaping how fans engage with America’s pastime. This section delves into the cessation of MLB broadcasts on ESPN, the impact of the NBA’s lucrative TV contract, and comparative regional sports ratings across leagues.

Cancellation of MLB on ESPN

ESPN’s decision to opt out of its MLB media rights deal has created ripples across the sports broadcasting sector. This move represents a major shift in the longstanding relationship between MLB and one of its key media partners.

The cancellation reflects sweeping changes in viewer habits and the evolving media ecosystem. As streaming platforms gain traction, traditional broadcast models are being re-evaluated.

This shift compels MLB to reassess its broadcasting strategy and seek new ways to connect with fans. The league must navigate a complex media landscape where digital platforms are increasingly pivotal.

Influence of NBA TV Contract

The NBA’s recent 11-year $76 billion television contract with ESPN, Amazon, and NBC has set a new standard in sports broadcasting agreements. This deal has ramifications far beyond basketball, affecting negotiations and expectations across every major sports league.

MLB now faces the challenge of securing similarly advantageous terms in future media rights contracts. The contrast between the NBA’s success and MLB’s current hurdles underscores the need for the league to think outside the box and come up with innovative strategies.

This NBA deal acts as both a target and a warning for Major League Baseball, illustrating the potential for vast revenue but also highlighting the shifting dynamics of sports media consumption.

Regional Sports Ratings Comparison

Despite national challenges, MLB maintains a strong performance in regional markets. In cities hosting both MLB and NBA teams, baseball frequently surpasses basketball in local TV ratings. For example, in 2022 in New York, the Yankees averaged a 3.0 rating, while the Knicks and Nets lagged at 0.9 and 0.8, respectively. In Los Angeles, the Dodgers achieved a 2.1 rating, higher than the Lakers (1.5) and Clippers (0.5). Similarly, in Philadelphia, the Phillies led with a 4.2 rating, compared to the 76ers’ 3.1.

This regional strength is both an opportunity and a challenge for MLB. While it underscores the local appeal of baseball, it also emphasizes the necessity to extend this success on a national level.

Grasping these regional dynamics is vital for MLB as it develops its broadcasting strategy, balancing local dominance with national appeal. By leveraging its regional stronghold and adapting to evolving media consumption habits, MLB can position itself for enduring success in the evolving sports media arena.

MLB’s Path Forward in Broadcasting

As MLB navigates an evolving media landscape, adapting its broadcasting strategy to align with shifting fan expectations and technological advancements is essential. This section highlights the significance of streaming, the effects of blackout policies, innovative approaches to media buying, and the RSN crisis.

Importance of Streaming for MLB

Streaming has become the cornerstone of modern sports consumption, and for MLB to remain competitive, it must fully embrace digital-first broadcasting. The decline of traditional cable subscriptions, the rise of cord-cutting, and the success of streaming-exclusive sports deals have reshaped how fans engage with live games. If MLB fails to adapt, it risks losing relevance with younger audiences and missing out on lucrative revenue opportunities.

MLB.TV has been a leader in sports streaming, offering fans an on-demand, high-quality viewing experience long before other leagues fully embraced the model. However, its effectiveness has been hindered by restrictive blackout policies, regional limitations, and pricing barriers that frustrate fans. To fully capitalize on streaming’s potential, MLB must:

- Expand Accessibility – Implement more in-market streaming options, similar to the NBA’s League Pass, allowing fans to watch local games without cable.

- Enhance the User Experience – Improve MLB.TV’s interface, latency, and interactive features (e.g., multiple camera angles, live stats, and betting integrations).

- Forge Strategic Partnerships – Secure exclusive streaming deals with Amazon, Apple, YouTube TV, or Hulu Live, similar to the NFL’s Amazon Prime deal for Thursday Night Football.

- Experiment with Alternative Broadcasts – Introduce personality-driven commentary like the ManningCast or data-rich, analytics-focused feeds tailored to different audiences.

- Leverage AI and Personalization – Utilize machine learning to curate highlights, suggest content, and customize viewing experiences based on fan preferences.

By prioritizing streaming innovation, MLB can future-proof its media strategy, capture younger audiences, and diversify its revenue streams beyond traditional broadcast deals. The key lies in breaking free from outdated regional restrictions and fully embracing the flexibility that modern fans demand.

Impact of MLB Blackout Policy

MLB’s current blackout policy has long frustrated fans and stymied growth. Designed to protect local broadcasters, these restrictions often hinder fans from watching their favorite teams, even if they are willing to pay for access.

The policy’s adverse effects are notably severe in areas with expansive blackout zones, preventing fans from watching multiple teams despite living far from any stadium. For example, in Iowa, fans cannot watch six different MLB teams—the Cubs, White Sox, Cardinals, Royals, Twins, and Brewers—despite not having an in-market team. Even with an MLB.TV subscription, many Iowans are left without access to nearby teams, frustrating devout fans and alienating potential new ones.

Getting rid of this policy altogether is essential for MLB’s future success. By addressing these excessive blackout zones, MLB ensures its most loyal supporters—no matter their location—can watch the teams that they cherish.

Innovative Media Strategies

To thrive in today’s media environment, MLB must pursue innovative media strategies. This could include forming alliances with non-traditional platforms, utilizing social media for live content, or crafting unique, digital-first programming. The NFL has set a strong example in this area, embracing alternative broadcast formats that appeal to diverse audiences.

For example, the Amazon Prime “Thursday Night Football” data-centric broadcast integrates advanced analytics, real-time stats, and alternate camera angles, enriching the experience for fans seeking in-depth insights. Meanwhile, ESPN’s ManningCast has redefined game presentation, offering a casual, personality-driven alternative that combines analysis and entertainment. These formats cater to various viewer preferences, enabling the NFL to expand its reach and engagement.

MLB would benefit from adopting similar strategies. Data-driven approaches to media buying can help MLB target specific audience segments more precisely by optimizing content distribution and advertising strategies based on viewing habits and engagement metrics. Additionally, experimenting with interactive broadcasts, alternate commentary feeds, or personalized viewing experiences could distinguish MLB in a crowded sports media landscape.

By adopting the multi-platform, customizable broadcast model that has proven effective for the NFL, MLB can attract both traditional fans and the next generation of viewers who demand on-demand, interactive, and personality-driven content.

The Regional Sports Network Crisis: A Ticking Time Bomb for MLB

MLB’s reliance on Regional Sports Networks (RSNs) has long been a cornerstone of its media strategy, but that foundation is now crumbling. With cord-cutting accelerating and RSNs struggling to stay profitable, teams that once relied on lucrative local TV contracts are now facing major revenue uncertainty. The bankruptcy of Diamond Sports Group (owner of Bally Sports RSNs), which holds broadcast rights for 14 MLB teams, has thrown a wrench into the league’s financial ecosystem. As fewer households subscribe to traditional cable, RSNs are losing subscribers at alarming rates, making it increasingly difficult to sustain long-term deals with teams.

The collapse of the RSN model presents both a challenge and an opportunity for MLB. On one hand, teams that lose RSN deals may suffer immediate financial hits, forcing MLB to step in with stopgap solutions. However, this crisis also gives the league a chance to accelerate its shift to a direct-to-consumer model, reducing reliance on third-party broadcasters. If MLB can enhance MLB.TV, improve in-market streaming options, and negotiate hybrid distribution deals (similar to how Amazon and Apple handle select games), it could take greater control of its media future while providing fans with a more flexible and modern viewing experience.

How the RSN Collapse Impacts Fans

For fans, the downfall of RSNs creates uncertainty, frustration, and limited access to their favorite teams. In many markets, RSNs have historically been the only way for fans to watch local games, particularly for casual viewers who rely on cable bundles. As RSNs disappear or cut back coverage, many fans are left scrambling for alternatives, often forced to sign up for multiple streaming services—or worse, losing access entirely.

For example, Bally Sports’ struggles have already led to disruptions for viewers of teams like the Arizona Diamondbacks and San Diego Padres, who suddenly found themselves without a clear option to watch their teams when Diamond Sports Group lost the rights to broadcast those games. This confusion not only alienates existing fans but also makes it harder to attract new viewers—especially younger audiences who expect seamless, affordable access to live sports.

In response, MLB must prioritize accessibility, ensuring that its next move—whether via MLB.TV, streaming partnerships, or new local broadcast arrangements—keeps games affordable and widely available. If the league mishandles this transition, it risks pushing frustrated fans away from the sport entirely, at a time when competition for attention is fiercer than ever.

Challenges and Opportunities in MLB’s Evolving Media Landscape

As MLB looks ahead, it must navigate a rapidly changing media and business landscape. From the looming threat of a labor strike to uncertainties in TV rights and the evolving nature of sports marketing, the league faces significant challenges and opportunities. Strategic adaptation and foresight will be key to sustaining growth and fan engagement.

Preparing for a Potential MLB Strike: Navigating the Fan Impact

A potential MLB strike presents a serious challenge, particularly concerning media rights, fan engagement, and financial stability. Ongoing discussions about economic reform highlight the urgency of the issue, necessitating proactive planning to minimize disruption. While labor disputes are primarily fought between owners and players, fans often bear the biggest burden—left without live baseball and forced to watch their favorite sport grind to a halt.

For a league already struggling with declining youth interest and increasing competition for attention, an extended work stoppage could alienate casual fans and frustrate even the most loyal supporters. Previous labor disputes, such as the 1994 MLB strike that canceled the World Series, left long-lasting scars, with attendance and TV ratings taking years to recover. With more entertainment options available today than ever before, MLB cannot afford a disengaged fan base that may not return when play resumes in the event of a strike.

Most importantly, MLB must be transparent with fans, providing clear and consistent communication on labor negotiations and offering engaging content alternatives to sustain interest. Without proactive efforts to keep baseball relevant during a potential strike, the long-term consequences on fan loyalty could be severe, setting the sport back in an era where every second of consumer attention is highly contested.

Navigating TV Rights Uncertainty

The changing landscape of TV rights and media consumption presents both a challenge and an opportunity for MLB. Traditional broadcasters are rethinking their commitments—ESPN has already scaled back its MLB deal, and the decline of regional sports networks (RSNs) threatens local viewership access.

To remain competitive, MLB should consider:

- Expanding partnerships with streaming giants like Amazon, Apple, or Netflix to engage digital-first audiences.

- Enhancing its direct-to-consumer (DTC) model through MLB.TV, offering more flexible, customizable, and regional viewing options.

- Creating new content packages to appeal to both casual fans and hardcore enthusiasts, incorporating behind-the-scenes access and alternate commentary formats.

- Utilizing data analytics to showcase engagement metrics and audience value to potential media partners, ensuring the league remains attractive to broadcasters.

The Time to Modernize Is Now

MLB is at a critical crossroads, and its hesitation to adapt is putting it further behind the NFL and NBA, both of which have fully embraced streaming, alternative broadcasts, and direct-to-consumer media strategies. While the NBA secures billion-dollar TV deals and the NFL dominates with streaming partnerships like Amazon Prime’s Thursday Night Football, MLB remains tied to outdated distribution models that restrict access and frustrate fans.

If the league doesn’t act decisively to modernize its approach, it risks losing the next generation of sports fans to leagues that offer more accessible, engaging, and tech-forward viewing experiences. The window to evolve is closing fast—MLB must prioritize streaming accessibility, eliminate blackout restrictions, and innovate its media presentation before it falls even further behind its competitors.

This isn’t just about keeping pace—it’s about survival in a rapidly changing sports media landscape. If MLB fails to adapt, it risks cementing itself as a second-tier league in the eyes of modern sports consumers. The time to act is now. Will Major League baseball embrace the future, or will they continue to watch from the dugout as the NFL and NBA take the lead?

Leave a comment